A Symptom of Cancer That Needs Medical Attention

By Cara Tremols

Cancer survivors are regularly, and more disproportionately, faced with financial distress. According to the National Cancer Institute, there’s a term that describes this specific burden on cancer survivors: financial toxicity.

“Financial toxicity is a term that means it’s a side effect of cancer,” said Jessica MacIntyre, executive director of Clinical Operations at Sylvester Comprehensive Cancer Center, part of the University of Miami Health System. “When it comes to our survivors, we have to look at them holistically, and that includes finances. Otherwise, patients suffer.”

To make ends meet, some patients have been known to sell their cars or move from one family member’s home to another.

“Patients feel like they have to make a choice,” MacIntyre said. “They either pay bills or they get cancer care, and sometimes they aren’t very open about it with their families. They may skip appointments or medications.”

In times of economic uncertainty, such as during the COVID-19 pandemic, the burden of financial toxicity increases. In 2020 (and even still as a result of the pandemic), many people were unable to work or go out because they were immunocompromised. Access to care became even more challenging because they were either providing care to their families or needed care from their family members. For some, that’s still true.

Lisa Meherb, director of Social Work at Sylvester, said that inflation is a challenge for many people right now, but especially for cancer patients and survivors.

“What once was considered a good-paying job may not be enough to guarantee basic necessities like housing, food and health care,” she said. “Rents have gone up across South Florida, and a lot of our patients are surviving based on the support of family members.”

Even for patients who are in a more fortunate position, the cost of care can cause a heavy toll on their mental health.

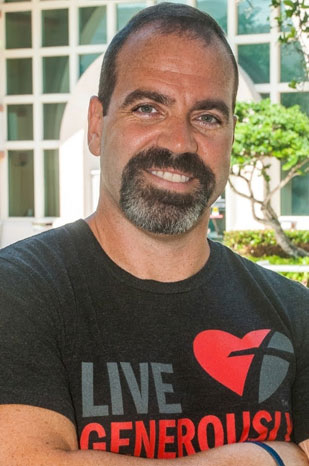

Jorge Calil, a three-time cancer survivor of Stage 4 Hodgkin’s lymphoma and a stem cell transplant recipient, describes the frustration he experienced managing his medical finances.

“The billing was more of a concern and a stress to me than my cancer diagnosis,” he said.

Calil said he often found himself angered by bills and confused about what his financial responsibilities were. Rather than focusing on healing, billing was constantly on his mind.

Even though Calil felt he was being proactive, he had to make some choices about what kind of care he was getting based on costs. At one point, he suspected his cancer was back and made the decision to schedule a radiology appointment for Christmas Eve rather than wait until the new year when his out-of-pocket maximum would reset to zero.

“It was a scan to confirm what I was dreading, that it’s back already,” he said. “I was more concerned about doing the CT in December so I wouldn’t have to pay anything out-of-pocket than I was about the results of the CT.”

Going through this experience, Calil wondered about other cancer patients and asked himself, How do they get by? Like a stay-at-home parent now has to put their kids in daycare if they don’t have family to help? Or someone with a 9-to-5 job who needed radiation five days a week?

“Without steady income, family or some type of financial assistance, cancer can mean financial ruin,” he said. “Fighting cancer is tough enough without having to worry about that, too.”

Screening for Financial Hardship

The Cancer Survivorship program does its best to make sure people don’t have to make these tough choices. Sylvester screens for financial toxicity in a few places.

The first screening method is via Sylvester’s oncology nurse navigators. Patients are assigned to an oncology nurse navigator with their first appointment. Among other concerns, patients are screened for financial barriers to care and may be immediately referred to social work. This cuts down the time it would take for a referral.

The second screening can happen during the pre-appointment survey. Before each appointment, patients are asked to fill out a questionnaire about their specific needs. This program, called My Wellness Check (MWC), provides a personalized health care experience to relay any current concerns, including financial stress. If people indicate that they’re experiencing financial toxicity, a social worker is assigned to help address the problem, reviewing insurance coverage, including out-of-pocket costs and limits, deductibles and copays. They also work to identify other financial stressors like transportation or child care.

Third, if they are open to it, patients can discuss their financial stress with their doctor. Talking about finances may not be a comfortable conversation, but when people feel empowered to talk about financial struggles, they can open doors to receive help.

“We often tell patients that not one resource will solve all your problems,” Meherb said.

Not all coverage is the same, just as each patient isn’t the same. The social worker has to understand a patient’s specific needs to identify the most appropriate tools and resources.

Let’s say you have high out-of-pocket costs, like medications. Your social worker will work to get you on a patient assistance program to get costs as close to $0 as possible. Or perhaps you’re paying out of pocket for care. That’s a huge financial strain in itself, but you might qualify for Medicaid. The team can help get that process started.

Maybe getting to and from your appointments is the challenge. Your social worker will check to see if your insurance offers free transit to and from your appointments. (Some do!) Sylvester also offers transportation program through a grant, so let the team know if transportation is a problem. Telehealth may be appropriate for certain appointments as well.

Get the Help You Need and Deserve

Here are some important takeaways if you or a cancer patient or survivor you know is experiencing financial toxicity:

- Not one source will provide all your solutions.

- Know your income versus your expenses.

- Cut down on bills (cell phones, memberships)

- Before purchasing wigs or medical devices, see if they might be available or reimbursable through your insurance. It’s worth noting that Sylvester does have a wig program and other lymphedema garments.

- Contact your utilities, mortgages or credit card companies regarding hardship programs.

Below are some organizations that may be able to help, but there are many more. A Sylvester social worker can help find the most appropriate resources for you.

- Cancer Financial Assistance Coalition

- CancerCare

- Family Reach

- The Leukemia & Lymphoma Society

- Triage Cancer

- NeedyMeds.com

- Good Days

- Patient Access Network Foundation

Bottom line: if you need help or are suffering from financial toxicity, please let your care team know.

“Don’t be afraid to talk about it,” MacIntyre said. “We can’t address it if we don’t know.”